1. Introduction

This management’s discussion and analysis (“MD&A”), dated August 14, 2019, provides a review of, and discusses the financial position and results of operations of, Almonty Industries Inc. (TSX: AII) (“Almonty” or the “Company”) for the three- and nine-month periods ended June 30, 2019. It should be read in conjunction with the unaudited interim condensed consolidated financial statements of the Company and notes thereto for the three and nine months ended June 30, 2019 (the “Q3 2019 Financial Statements”).

The Company’s management is responsible for the preparation of the Company’s consolidated financial statements as well as other information contained in this MD&A. The board of directors of Almonty (the “Board of Directors”) is required to ensure that management assumes its responsibility in regard to the preparation of the Company’s financial statements. To facilitate this process, the Board of Directors has created an audit committee (the “Audit Committee”). The Audit Committee meets with members of the management team to discuss the operating results and the financial results of the Company, before making their recommendations and submitting the Q3 2019 Financial Statements and MD&A to the Board of Directors for review and approval. Following the recommendation of the Audit Committee, the Board of Directors approved the Q3 2019 Financial Statements and this MD&A on August 14, 2019.

The Q3 2019 Financial Statements have been prepared in accordance with International Accounting Standard (“IAS”) 34 “Interim Financial Reporting”.

All currency figures in this MD&A appear in thousands of Canadian dollars, except per share amounts, unless otherwise stated.

Additional information about the Company, including the Q3 2019 Financial Statements, is available on the Company’s website at www.almonty.com and on SEDAR (www.sedar.com) under Almonty’s profile.

Forward-Looking Information

This MD&A contains forward-looking statements that reflect management’s expectations, estimates and projections concerning future events in relation to the Company’s business and the economic environment in which it operates. Forward-looking statements may include, but are not limited to, statements with respect to possible acquisitions, demand for tungsten, tungsten prices, tungsten recovery and production, reductions in operating and unit production costs, improvements in efficiencies or reduction in dilution, future remediation and reclamation activities, future mineral exploration, the estimation of mineral reserves and mineral resources, the realization of mineral reserve and mineral resource estimates, the timing of activities and the amount of estimated revenues and expenses, the success of exploration activities, permitting time lines, the success of mine development and construction activities, the success of future mine operations, the success of other future business operations, requirements for additional capital and sources and uses of funds. Any statements that express or involve discussions with respect to

predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “estimates”, “intends”, “strategy”, “goals”, “objectives” or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be “forward-looking statements”.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events, results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the inability of the Company to maintain its interest in its mineral projects or to obtain or comply with all required permits and licenses, risks normally incidental to exploration and development of mineral properties, uncertainties in the interpretation of drill results, the possibility that future exploration, development or mining results will not be consistent with expectations, changes in governmental regulation adverse to the Company, lack of adequate infrastructure at the mineral properties, economic uncertainties, the inability of the Company to

obtain additional financing when and as needed, competition from other mining businesses, the future price of tungsten and other metals and commodities, fluctuation in currency exchange rates, title defects and other related matters. See Section 8 in this MD&A and under the heading “Risk Factors” in the Company’s Annual Information Form dated January 11, 2019 for a further discussion of factors that could cause the Company’s actual results, performance or achievements to be materially different from any anticipated results, performance or achievements expressed or implied by forward-looking statements. The forward-looking statements in this MD&A represent the expectations of management as of the date hereof and accordingly, are subject to change after such date. Readers should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. The Company does not undertake to update any forward-looking information, except as, and to the extent, required by applicable laws. The forward-looking statements contained herein are expressly qualified by

this cautionary statement.

A glossary of terms is affixed to the end of this MD&A. Capitalized terms used but not otherwise defined herein have the respective meanings ascribed thereto in the glossary of terms.

2. Overview

Almonty is a publicly-traded company listed on the Toronto Stock Exchange (the “TSX”) (formerly listed on the TSX Venture Exchange (the “TSXV”)), under the symbol “AII” (see TSX Listing section below). The principal business of Almonty is the mining, processing and shipping of tungsten concentrate from the Los Santos tungsten mine located near Salamanca, Spain (the “Los Santos Mine”), the processing and shipping of tungsten concentrate from the Panasqueira tin and tungsten mine in Covilha, Castelo Branco, Portugal (the “Panasqueira Mine”), as well as the evaluation of the Sangdong tungsten mine project located in Gangwon Province, Republic of Korea (the “Sangdong Mine”) and the evaluation of the Valtreixal tin and tungsten mine project located in Western Spain in the province of Zamora (the “Valtreixal Mine”).

The Los Santos Mine was acquired by Almonty in September 2011 and is located approximately 50 kilometers from Salamanca in western Spain and produces tungsten concentrate. The Panasqueira Mine, which has been in production since 1896 and is located approximately 260 kilometers northeast of Lisbon, Portugal, was acquired in January 2016. The Sangdong Mine, which was historically one of the largest tungsten mines in the world and one of the few long-life, high-grade tungsten deposits outside of China, was acquired by Almonty in September 2015. Almonty also owns a 100% interest in the Valtreixal Mine in northwestern Spain, having exercised its option to acquire the remaining ownership in the Valtreixal Mine on December 21, 2016.

Almonty acquired 100% of the shares capital of Wolfram Camp Mining Pty Ltd (“WCM”) and Tropical Metals Pty Ltd (“TM”) (which collectively own a 100% interest in the Wolfram Camp Mine) from Deutsche Rohstoff AG (“DRAG”) on September 22, 2014. Production at the Wolfram Camp Mine had been suspended during the period of time that Almonty had been refurbishing the mill. However, during the nine-month-period ended June 30, 2019, the Board of Directors determined that it was in the best interests of the Company to cease expending further funds towards refurbishment and, consequently, the Company caused WCM and TM to be placed into voluntary liquidation with all requisite approvals received.

On June 4, 2015, Almonty acquired an 8% interest in Woulfe Mining Corp. (“Woulfe”) and, through the acquisition of convertible debentures in Woulfe, gained control over Woulfe with the ability to nominate a majority of the board members. On July 7, 2015, Almonty and Woulfe entered into an arrangement agreement (the “Arrangement Agreement”) in respect of the acquisition by Almonty of all of the issued and outstanding shares of Woulfe that it did not already own by way of a plan of arrangement under the Business Corporations Act (British Columbia) (the “Plan of Arrangement”).

On August 21, 2015, Woulfe shareholders approved the Plan of Arrangement. On September 10, 2015, Almonty completed the Plan of Arrangement and acquired all of the shares of Woulfe that it did not already own, leading to Almonty having a 100% ownership interest in Woulfe. The principal asset of Woulfe is the Sangdong Mine.

On January 6, 2016, Almonty acquired 100% of the issued and outstanding shares of Beralt Ventures Inc. (“BVI”) from Sojitz Tungsten Resources Inc. for €1.00. In connection therewith, Almonty acquired and purchased €12,260 in aggregate principal amount of debt owed by Beralt Tin & Wolfram (Portugal), S.A. (“Beralt”), a wholly-owned subsidiary of BVI, to Sojitz Corporation of Japan in exchange for a cash payment of €1,000 on closing and a promissory note issued by Almonty in the principal amount of €500, bearing interest at 4% per annum, maturing December 29, 2017 (paid) (the “January 2016 Note”). BVI, through its wholly-owned subsidiaries, is the 100% owner of the Panasqueira Mine.

On December 21, 2016, Almonty exercised its option to acquire the remaining 49% of the Valtreixal Mine it did not already own for payment of €1.5 million ($2.2 million). Almonty now owns a 100% interest in the Valtreixal Mine.

TSX listing

Almonty received final approval from the TSX to graduate the listing of its common shares from the TSXV to the TSX after fulfilling certain standard and customary conditions required by the TSX. Upon completion of the final listing conditions on June 1, 2018, Almonty’s common shares were simultaneously delisted from the TSXV and began trading on the TSX.

OTCQX listing

On July 12, 2018, the Company began trading in the United States on the OTCQX Best Market (“OTCQX”) under the symbol ALMTF. U.S. investors can find current financial disclosure and real-time Level 2 quotes for the Company on the OTCQX website.

Further information about the Company’s activities may be found at www.almonty.com and under the Company’s profile at www.sedar.com

Market for Tungsten Concentrate

Market demand for tungsten concentrate continued to be stable from the fourth quarter of fiscal 2017 and through to Q2 2019 with the pricing environment improving each quarter to September 2018 and with a leveling off between October 2018 and June 2019. Current Spot APT price is approximately $252 as at the end of June 2019 and with a high of US$350 per MTU of APT during the month of June 2018. Management expects that the limited quantities of “spot” concentrate available in the market will help with continued price improvement in the near to mid-term (during the last half of calendar 2019) with several forecasting services projecting prices to exceed US$315 per MTU of APT by late 2019.

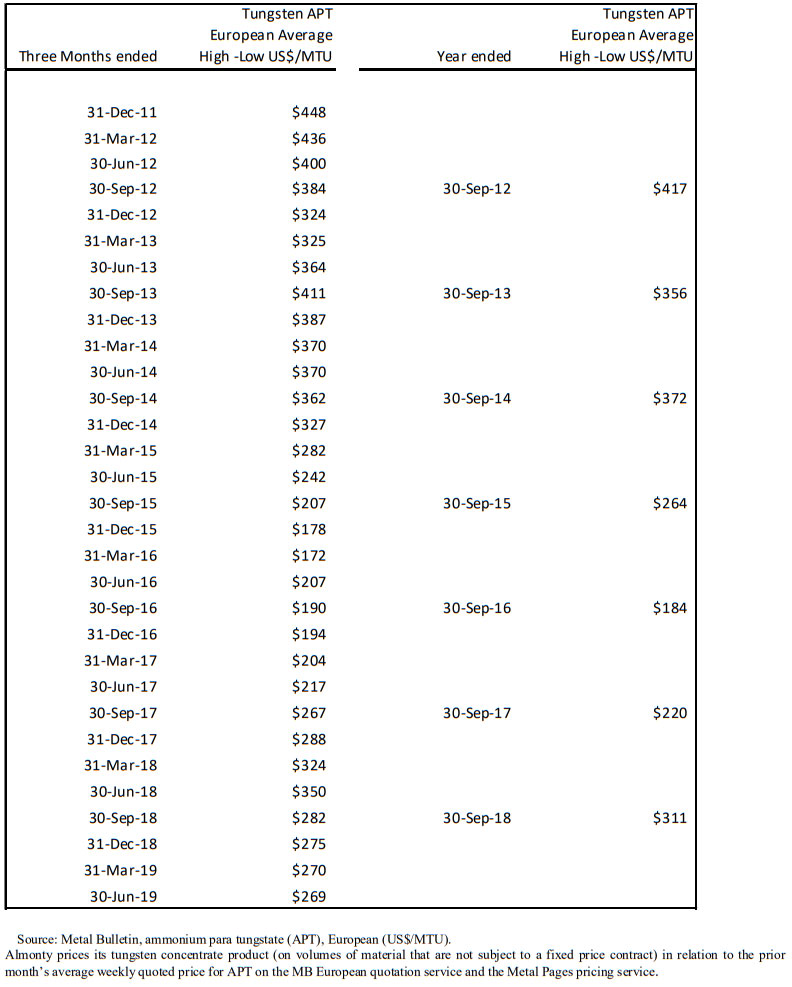

The average of the high and low weekly quoted price for European APT according to the Metal Bulletin (“MB”) European weekly quotation for APT (from which Almonty’s concentrate prices are derived by the formulae under its Supply Agreements) averaged the following:

Los Santos Mine

MTU production during the three months ended June 30, 2019 (“Q3 2019”) decreased by 50.5% when compared to the three months ended June 30, 2018, (“Q3 2018”) as a result of the fact that the Company has changed its mine plan at Los Santos, whereby it ceased further mining of ore and commenced processing of its tailing during Q3 – 2019.

Almonty continues to focus on cost control and its cost reduction program. Unit cash operating costs are anticipated to continue a downward trend as the grade of ore processed returns to levels that are within the optimal design specifications of the processing plant. Unit costs are expected to continue their variability over time along with the variability in the grade of ore milled during any give period.

Panasqueira Mine

Almonty acquired the Panasqueira Mine on January 6, 2016.

During Q3 2019, management at Panasqueira determined that it would mine certain ore with a lower grade so as to enable work to be done to ensure that access to ore with the usual higher grade will be accessible into the future. The tungsten recovery rate continued to improve during Q3 2019 when compared to Q3 2018 and Q2 2019 and is now in line with the expected average tungsten recovery rate for the life of mine, expected to be maintained in the 60-65% range.

Almonty continued its focus on cost reduction and all-in-production costs at Panasqueira continued to decrease. Mined grades continued to improve throughout Fiscal 2018 and in to Q3 2019 as expected under the revised mine plan implemented by Almonty since its acquisition in January 2016. Mined grades in Q3 2019 continued to show improvement in the content of by-product payable metals as well (copper and tin) which are improving the overall cash flow profile of the mining operation.

Panasqueira is a poly-metallic wolframite deposit as opposed to a skarn deposit scheelite mine like Los Santos. Tungsten recovery rates for wolframite deposits are typically higher than for scheelite deposits. The Panasqueira Mine has some of the highest tungsten recovery rates in the industry, consistently averaging 80%.

Almonty anticipates that the grades of ore mined will continue trending towards the long-term average of the remaining life of mine of 0.185% (see NI 43-101 technical report on the Panasqueira Mine dated December 31, 2016 filed on SEDAR under Almonty’s profile, also available on the Company’s website www.almonty.com) through the refinement of the life of mine plan. The expected increased grades are continuing to have an impact on the level of production currently being experienced and the increase in contained tungsten is also having a positive impact on unit costs as at the date of this MD&A.

On May 15, 2017, the Company announced that it had entered into an agreement with Crominet Mining Processing SA (PTY) Ltd (“Crominet”) whereby Crominet will install and operate a series of XRT ore sorting and other ancillary equipment with sufficient capacity to treat all of the tailings generated by Panasqueira’s heavy media separation unit. The installation of the XRT ore sorting equipment is expected to increase the overall tungsten recovery rate at the mine by 10%. The XRT ore sorting installation is progressing well and is expected to be operational by the fourth quarter of calendar 2019.

Valtreixal Mine

During Q1 2017, Almonty exercised its option to acquire the remaining 49% interest in the project for a payment of €1.5 million ($2.2 million) in December 2016, a reduction of €0.75 million ($1.1 million) from the previously agreed price, resulting in a much-needed saving of capital on the acquisition. The Company is continuing to carry out work on the project and is working towards a final decision on proceeding with the development of the project. The Company continues to fine-tune its planning and budgeting for the potential build-out and commissioning of the Valtreixal Mine.

Sangdong Mine

On August 29, 2016, Almonty completed an updated technical report prepared pursuant to NI 43-101 entitled “Technical Report on the Mineral Resources and Reserves of the Sangdong Project, South Korea” (the “Sangdong Technical Report”) that is available under Almonty’s profile on SEDAR (www.sedar.com) and on the Company’s website (www.almonty.com).

Almonty is continuing to work with KfW IPEX-Bank GmbH to provide a funding package for the buildout of the Sangdong mine in its entirety (see below). The Company is continuing with the development and permitting required to commence construction once the appropriate funding package has been put in place.

On December 28, 2017, Almonty entered into an engineering, procurement and construction (“EPC”) contract with POSCO E&C for the development work at the Sangdong Mine. POSCO E&C is one of the top tier general contractors in Korea and a subsidiary of the third largest steel company in the world. The EPC contract is a turnkey based contract for the development and construction of primary facilities for processing tungsten ore mined out of the Sangdong Mine. Under the EPC contract, POSCO E&C is responsible for not only engineering, civil & architectural, machinery & electrical works of processing plant and auxiliary facilities, but also commissioning of such facilities.

The EPC contract has a net contract price of KRW40.3 billion (approx. US$37.3 million) and, including the value of primary equipment which will be erected and installed by POSCO E&C, the EPC price reaches KRW54.0 billion

(approx. US$50.0 million) which accounts for 65% of the total capital expenditure budgeted for the Sangdong Project. The remaining 35% will be spent for the development of underground transportation galleries and accesses to tungsten veins, mine infrastructure, backfill plant, owner’s cost, and other expenses. The primary facilities of the processing plant will be built for 900,000 to 1.2 million tonnes per annum capacity while the initial years of operation targets 640,000 tonnes per annum. The EPC contract stipulates a construction period of 18 months and commissioning period of 6 months. Following general rules of EPC contracts, cost overrun, and project delay will be the responsibility of the EPC Contractor.

On March 12, 2018, Almonty entered into a new off-take agreement with an existing customer for the tungsten concentrate to be mined and processed at the Sangdong Mine. The agreement has a term of 10 years and, based upon current pricing models and subject to the terms and conditions of the agreement, the agreement calls for revenues for the Company for a minimum of $500-million over a 10-year period.

The realization of the benefits of the off-take agreement are subject to risk factors typical of a supply agreement of this nature, including if the Company is unable to meet its obligations to deliver tungsten concentrate in accordance with the terms of the off-take agreement, variable costs of shipping and production over the term of the contract, the customer’s ability to purchase the tungsten concentrate produced by Almonty at the mine, and the continued economic viability of the customer or its successors for the life of the off-take agreement. Finally, given these risks, there is no guarantee that the Company will realize the revenues contemplated under the terms of the off-take agreement.

KfW IPEX-Bank GmbH has consented to Almonty Industries Inc. disclosing KfW IPEX-Bank GmbH as the lender and has released the general terms of the proposed debt project financing for Almonty’s Sangdong mine in Korea. The project financing approval process is now in the late stage of finalization by the bank, with due diligence almost complete.

The general terms of the proposed project financing to be provided by KfW IPEX-Bank GmbH are:

- $73-million (U.S.) principal amount senior project finance loan secured on the Sangdong mine;

- Interest to be based on normal commercial European lending rates;

- Term of 8.25 years with an initial principal repayment holiday and repayments of principal commencing after the second anniversary of the initial drawdown;

- Oesterreichische Kontrollbank AG is committed to evaluating to provide a substantial finance cover guarantee based on the previously announced long-term off-take agreement.

Almonty has announced that it has obtained the clearance and acceptance by the Lending Bank, KfW-IPEX Bank, of the final technical due diligence report on the Sangdong Mine Development Project submitted by the Independent Engineer. The final acceptance of the Independent Engineer’s report signifies the clearance of certain pending issues related to compliance with the Equator Principles and, therefore, the project is now moving forward to the next stage of financial closure.

Almonty has worked closely with the Independent Engineer in the past several months to ensure sustainable development outcomes and the integration of environmental, safety and social considerations into the project development procedures, meeting the stringent international standards and guidelines.

Almonty also announced the mechanical completion and the commencement of commissioning of the government-subsidized pilot plant at the site.

The project financing commitment is now subject to the execution of definitive loan and security documentation. In the meantime, work is continuing at the Sangdong site to ensure the timely commissioning as requested by Almonty’s customer under the previously announced off-take agreement for the Sangdong Mine.

Financial Highlights

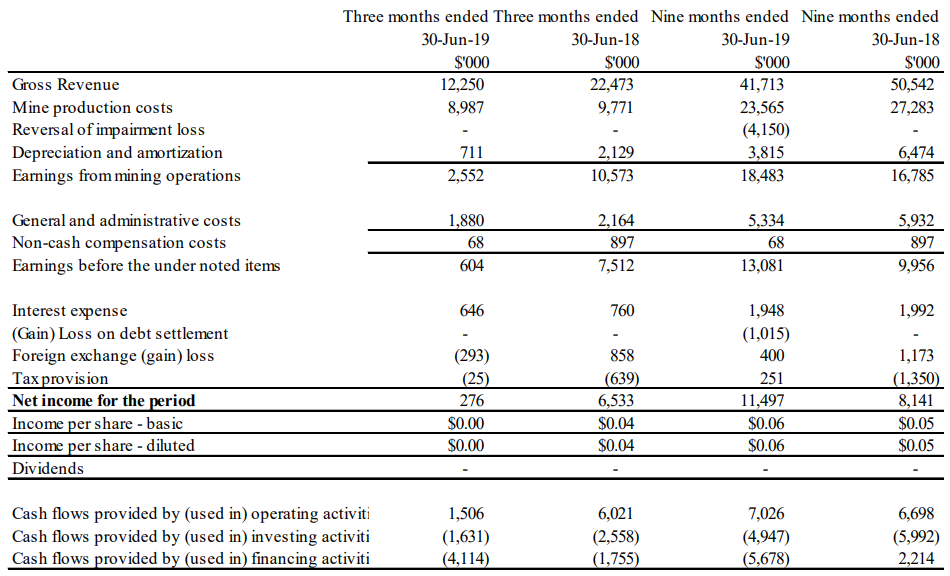

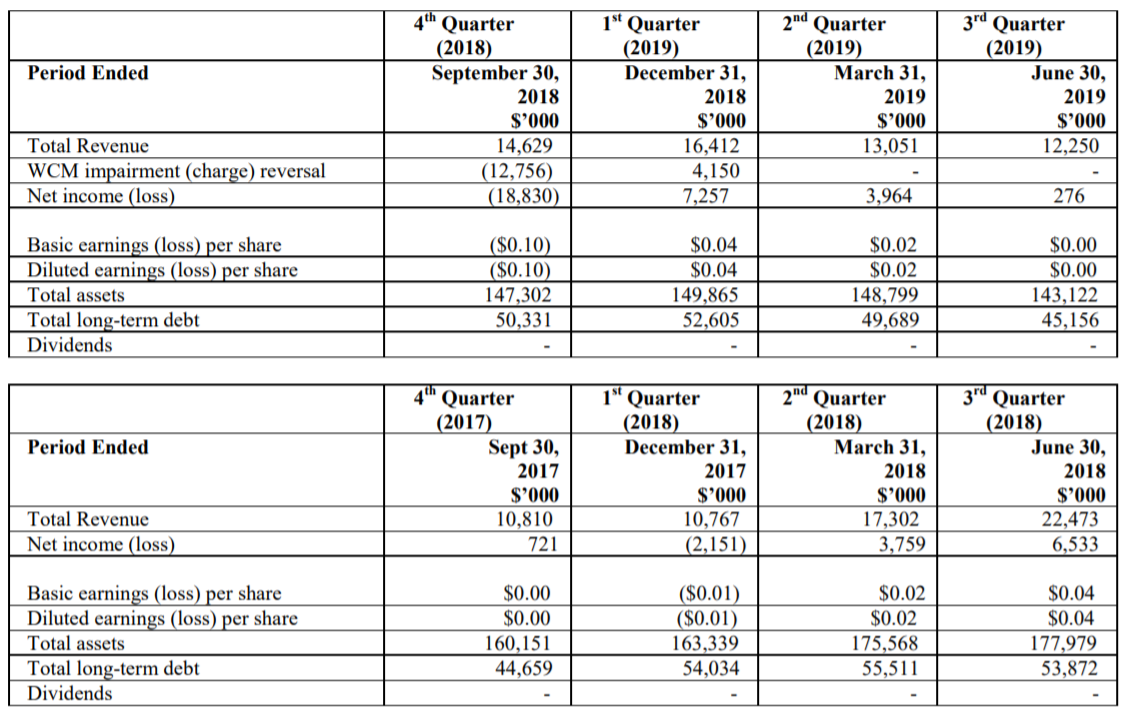

The following financial information is for the periods from October 1, 2018 to June 30, 2019, and from October 1, 2017 to June 30, 2018:

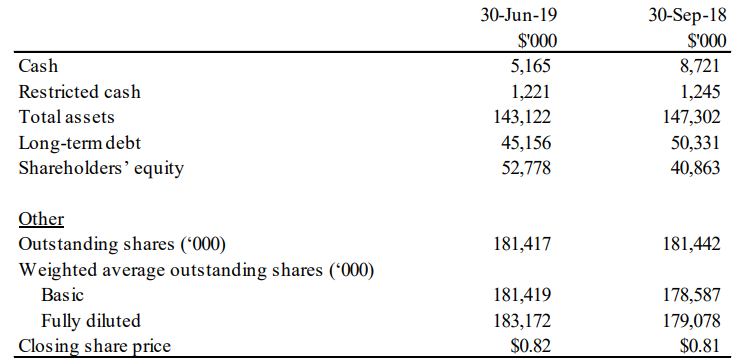

The following table sets forth a summary of the Company’s consolidated financial position as of the date presented:

Three Months Ended June 30, 2019 (“Q3 2019”) Compared to the Three Months Ended June 30, 2018, (“Q3 2018”)

Gross revenue for Q3 2019 was $12,250 ($22,473 for Q3 2018). Production volumes decreased by 50.5% when compared to Q3 2018. Production decreased by 67.5 % at the Los Santos mine and decreased by 31.0% at the Company’s Panasqueira mine. Decreased overall production at the Panasqueira mine was a result of i) mining lower grade ore so as to enable planned underground maintenance to ensure continued mining of higher-grade ore into the future and ii) reduced amount of ore mined and processed during Q3 2019 when compared to Q3 2018. Shipment volumes decreased by 32.6% overall in Q3 2019 when compared to Q3 2018. Overall revenue decreased by $10,223 or 45.6% in Q3 2019 when compared to Q3 2018 because of a decrease in the volume of units shipped as well as by a moderate drop in the selling price of the units shipped when compared to Q3 2018. The average commodity price experienced during Q3 2019 was 23.2% lower than the average commodity price in Q3 2018.

Mine production costs for Q3 2019 (including direct mining costs, milling costs, tailings costs and waste rock stripping costs associated with current production but excluding inventory write-downs and reversals of prior year inventory write-downs) decreased by 8.0%, or $784, when compared to Q3 2018. This decrease resulted mainly from decreased stripping costs associated with mining activities at the Company’s Los Santos mine when compared to Q3 2018.

The Company carries out a quarterly revaluation of its ore and in-process ore and finished goods inventory as well as its stockpiles of long-term tailings inventory to ensure that the carrying is recorded at the lower of cost and net realizable value. Any adjustments to the carrying value of ore, in-process ore and finished goods inventory are included in costs of goods sold (mine production costs). No writedowns of finished goods inventory were recognized during Q3 2019 or Q3 2018. Any adjustment to long-term tailings inventory that is recognized as an impairment amount is expensed through the statement of operations as an addition to Mine production costs. Conversely, any adjustment to long-term tailings inventory that is recognized as a reversal of prior period impairment charges is recorded as a reduction in Mine production costs. Reversals may occur in future periods as a result of continued

increases in the expected price of an MTU of APT in future periods.

In accordance with the Company’s accounting policy, operating mines are evaluated for indicators of impairment. Where indicators of impairment are present, such as when events or changes in circumstances suggest that the carrying amount of the operating mines may not be recoverable, the Company will test for impairment. The Company generally uses a discounted cash flow model to determine the value in use (VIU) for its operating mines where there are indicators of impairment. The assessment is done at the cash generating unit level (“CGU”) level, which is the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets. A CGU is generally an individual operating mine and its related long-term assets. An impairment loss is recognized when the carrying amount of the CGU exceeds the recoverable amount.

As a result of the fact that the Company has changed its mine plan at Los Santos, whereby it ceased further mining of ore and commenced processing of its tailing during Q3 – 2019, the Company tested for impairment at Daytal at September 30, 2018 and June 30, 2019. As a result, the Company determined that no impairment loss existed as at September 30, 2018 or June 30, 2019. Depreciation and amortization expense for Q3 2019 decreased by 66.7%, or $1,418 when compared to Q3 2018 due to a change in the Company’s mine plan at Los Santos during the year ended September 30, 2018. Almonty employs a unit-of-production basis for recording depreciation and amortization. (See Note 3 of the Company’s Q3 2019 Financial Statements for additional information).

Income from mining operations during Q3 2019 was $2,552, a decrease of $8,021 over income from mining operations in Q3 2018 of $10,573.

General and administrative costs decreased by $284 or 13.1% during Q3 2019 when compared to Q3 2018 because of more efficient cost controls. General and administrative costs include employee salaries and employment-related expenses of all non-mining/processing personnel as well as corporate overhead costs, business development and corporate development costs, listing and transfer agent fees, accounting, legal and other professional fees and travel.

Interest expense decreased by 15%, or $114, during Q3 2019 as a direct result of lower interest rates on the Company’s LIBOR based bank loans and a favorable foreign exchange rate change during the period.

Foreign exchange losses (gains) on the translation of United States dollar revenue into Canadian dollars and the revaluation of interest-bearing long-term debt and non-interest-bearing trade payables denominated in United States dollars of ($293) were incurred during Q3 2019 due to the appreciation of the Canadian dollar versus the United Sates dollar. This compared to a foreign exchange loss of $858 in Q3 2018.

Net Income (loss) for Q3 2019 was $276 or $0.00 earnings per common share. This compares to net income of 6,533 or $0.04 per common share, for Q3 2018.

Cash provided by (used in) operating activities totaled $1,506 and $6,021 for Q3 2019 and Q3 2018, respectively.

Cash used in investing activities totaled $1,631 for Q3 2019 ($2,558 for Q3 2018). These amounts relate to capitalized stripping costs at the Company’s Los Santos Mine and capitalized exploration and evaluation expenditures related to the Company’s Sangdong mine project in Korea, totaling $1,222.

Cash (used in) provided by financing activities totaled $4,114 during Q3 2019 and was comprised of repayment of long-term debt. Cash (used in) provided by financing activities during Q3 2018 was $1,755, consisting mainly of the repayment of long-term debt.

Nine Months Ended June 30, 2019 (“H3 2019”) Compared to the Nine Months Ended June 30, 2018, (“H3 2018”)

Gross revenue for H3 2019 was $41,713 ($50,542 for H3 2018). Production and shipment volumes were down 15.8% and 5.5%, respectively, in H3 2019 when compared to H3 2018.

Mine production costs during H3 2019 (including direct mining costs, milling costs, tailings costs and waste rock stripping costs associated with current production but excluding any impairment or the revaluation of inventory using the lower of cost and net realizable value because of any decreases in the commodity price) decreased by 13.6% when compared to H3 2018.

Depreciation and amortization expense for H3 2019 decreased by 41% compared to H3 2018 due to a change in the Company’s mine plan during the year ended September 30, 2018. Almonty employs a unitof-production basis for recording depreciation and amortization. (See Note 3 of the Company’s Q3 2019 Financial Statements for additional information.)

Income from mining operations was $18,483 during H3 2019 (after recognizing a reversal of impairment loss of $4,150), an improvement of $1,701 when compared to income from mining operations of $16,785 in H3 2018, due to the addition of more cost-efficient production from the Company’s Panasqueira mine.

General and administrative costs decreased $598 in H3 2019 when compared to H3 2018. General and administrative costs include employee salaries and employment-related expenses of all nonmining/processing personnel as well as corporate overhead costs, business development and corporate development costs, listing and transfer agent fees, accounting, legal and other professional fees and travel.

Foreign exchange losses (gains) on the translation of United States dollar revenue into Euros and the revaluation of interest-bearing long-term debt and non-interest bearing trade payables denominated in United States dollars of $400 were incurred during H3 2019. This compared to a foreign exchange loss of $1,173 in H3 2018.

The Company also recognized a deferred tax provision of 251 in H3 2019 compared to a deferred tax gain of $1,350 in H3 2018.

The Net income for H3 2019 was 11,496 or $0.06 per common share. This compares to net income of $8,141 or $0.05 per common share, for H3 2018.

Cash provided by (used in) operating activities totaled $7,026 and $6,698 for H3 2019 and H3 2018, respectively.

Cash used in investing activities totaled $4,947for H3 2019 ($5,992 for H3 2018). These amounts relate largely to the capitalized stripping costs at the Company’s Los Santos Mine and capitalized exploration and evaluation expenditures related to the Company’s Sangdong Mine project in Korea.

Cash (used in) provided by financing activities totaled ($5,678) and $2,214 for H3 2019 and H3 2018, respectively, and was comprised of principal repayments on existing debt and proceeds from new borrowings and from equity financings.

Liquidity and Capital Resources

As at June 30, 2019, the Company had cash and receivables of $7,225 (September 30, 2018 – $13,355) and a working capital deficiency of $26,718 (September 30, 2018 – $28,622). The Company believes that, based on the current price of APT and its forecast production schedule for the balance of fiscal 2019, it has the ability to generate sufficient cash flow to meet its current obligations at its producing mines. The Company will, however, need to refinance various long-term debt facilities that are coming due in the current year and raise additional capital to complete the development and build-out of the Sangdong Mine. The current price of APT has reached levels where it is sufficient to cover the Company’s cash operating costs on existing production volumes. Should the Company no longer be able to produce tungsten concentrate in sufficient quantity, then the Company may not be able to meet its current and

long-term obligations. Outside of abiding by (i) Spanish law requirements on minimum capital adequacy at Valtreixal Resources Spain SL, Daytal Resources Spain SL, (ii) Korean law requirements on minimum capital adequacy at Almonty Korea Tungsten, and (iii) Portuguese law requirements on minimum capital adequacy at Beralt Tin and Wolfram (Portugal) SA, there is no legal restriction on Almonty’s ability to repatriate capital from its subsidiaries.

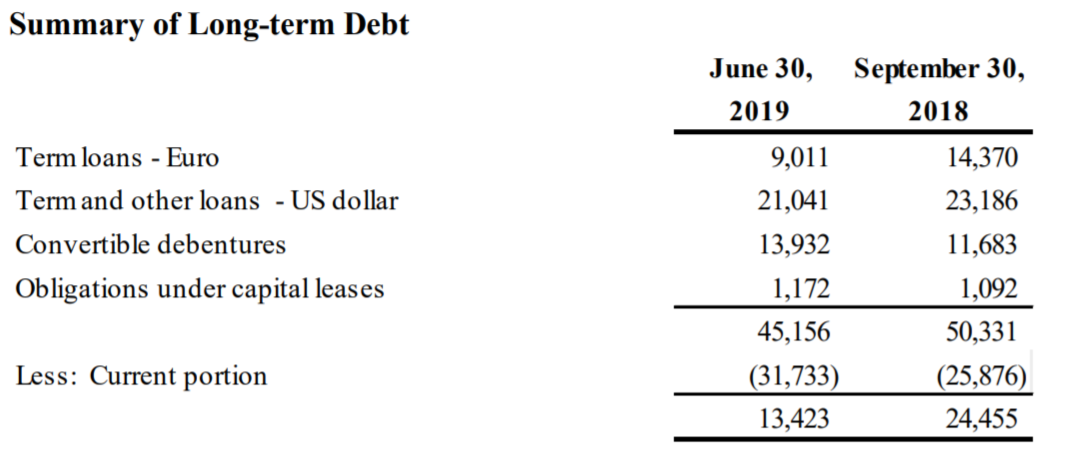

The Company has $45,156 in long-term debt as at June 30, 2019 ($50,331 as at September 30, 2018), of which $31,733 is the current portion ($25,876 as at September 30, 2018), comprised of individual facilities with Spanish domiciled banks, one facility with a US subsidiary of an Austrian bank, promissory notes owed to third parties and promissory notes owed to a shareholder and convertible debentures as at June 30, 2019. See Note 8 in the Q3 2019 Financial Statements for additional detail regarding each component of long-term debt.

On December 18, 2018, the Company completed a non-brokered private placement of an unsecured convertible debenture with a principal amount of $2,000, which debenture was acquired by DRAG. The debenture will mature on December 31, 2019 and bears interest at a rate of 6.0% per annum, payable semi-annually. Almonty may elect to convert the debenture into common shares upon the availability to the Company of full funding for the Sangdong Mine project at a conversion price equal to the higher of (a) the price per share in any equity financing completed by the Company after the date of issuance of the debenture and prior to the conversion or the maturity date of the debentures for purposes of financing the Sangdong Mine project and $0.628. However, the Company may not convert the debentures if at any time the Company’s shares trade below $0.628% per share or if such conversion would result in DRAG holding more than 19.9% of the Company’s issued and outstanding common shares.

During Q1 2019, the Company and DRAG agreed to an extension of the maturity date of its convertible debentures described in note 8(d)(iv) of the Q3 2019 financial statements.

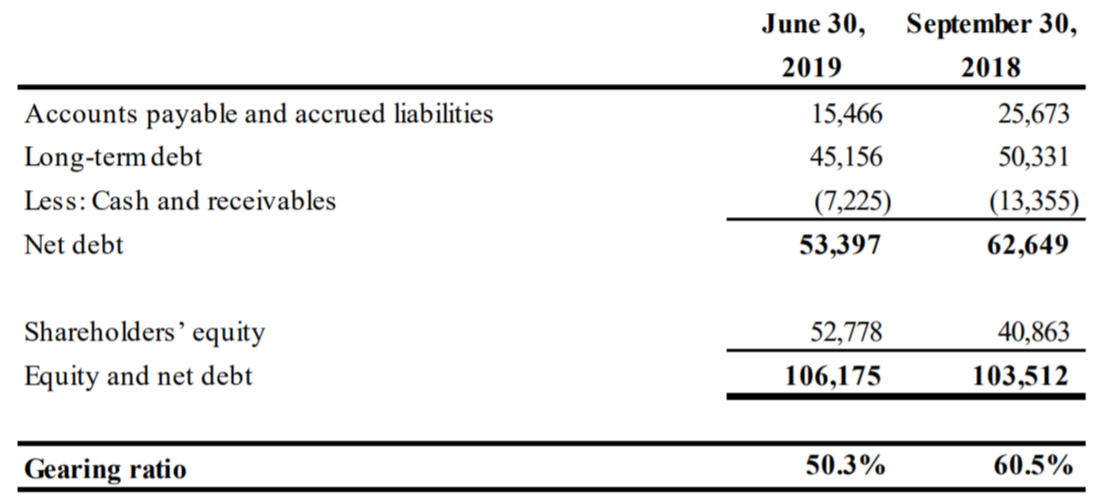

Summary of Gearing Ratio

The primary objective of Almonty’s capital management is to ensure that it maintains a strong credit rating and healthy capital ratios in order to support its business and maximize shareholder value. The Company manages its capital structure (composed of shareholders’ equity and net debt) and makes adjustments to it, in light of changes in economic conditions. To maintain or adjust the capital structure, Almonty may adjust the dividend payment to shareholders, return capital to shareholders or issue new shares. Almonty monitors capital using a gearing ratio, which is net debt, divided by equity plus net debt. Almonty’s policy is to maintain the gearing ratio between 5% and 40%. Net debt for this purpose includes interest-bearing loans and borrowings and trade and other payables, less cash and cash equivalents and receivables from government tax authorities. Almonty is not exposed to any externally

imposed capital requirements.

The gearing ratio, although improving, exceeded the targeted range as at June 30, 2019 and September 30, 2018 due to the deterioration in the commodity price environment in 2015 and 2016 having had a negative impact on net income (loss). In calendar 2017 and 2018 and 2019, the commodity price environment has significantly improved, resulting in an improvement in the Company’s cash flow generation capabilities. The Company is working to improve its profitability, raise additional equity capital and /or reduce its outstanding debt levels in order to return the gearing ratio to targeted levels.

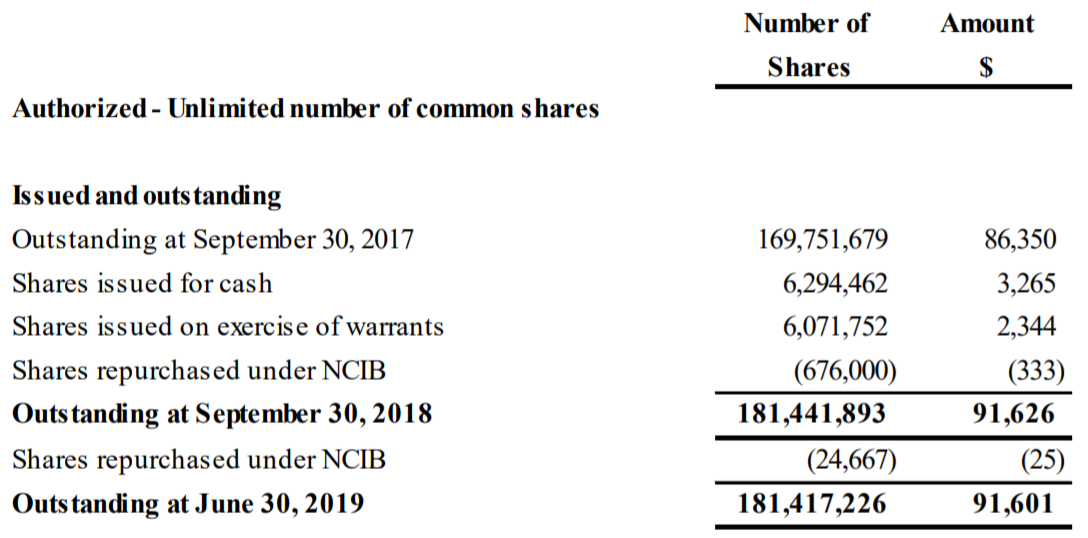

Outstanding Share Data

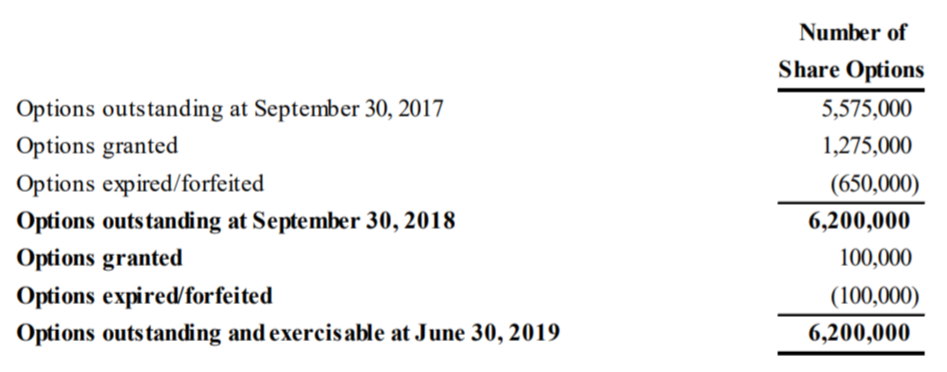

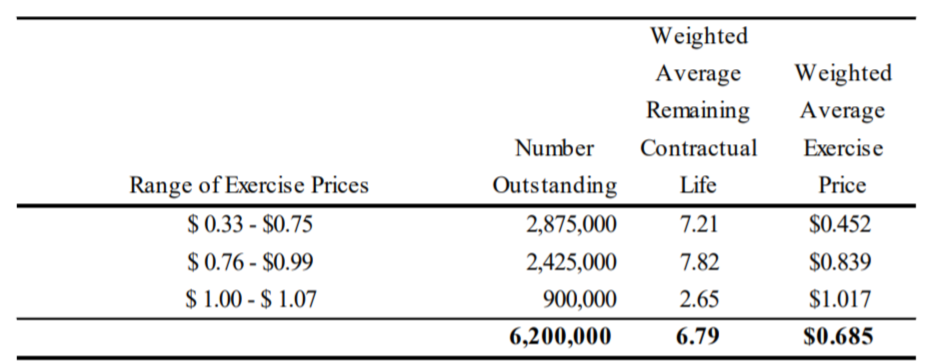

As of the date hereof (August 14, 2019), there were 181,417,226 common shares outstanding 6,200,000 options outstanding, with each option entitling the holder thereof to acquire one common share of Almonty, and no outstanding warrants.

As at June 30, 2019, the Company had the following Common Shares outstanding:

Outstanding stock options as at June 30, 2019:

The Company has established a stock option plan for its directors, officers, employees and technical consultants under which the Company may grant options to acquire a maximum number of common shares equal to 10% of the total issued and outstanding common shares of the Company. As of the date hereof there are 6,200,000 options outstanding, all of which are under this stock option plan, which was last approved by the Company’s shareholders at the Company’s Annual and Special Meeting of Shareholders held on March 28, 2018. All of the outstanding options are fully vested.

As of June 30, 2019, the outstanding options, all of which are exercisable, are summarized as follows:

There are no outstanding warrants as at June 30, 2019.

3. Quarterly Earnings and Cash Flow

4. Critical Accounting Estimates

The preparation of Almonty’s consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities and contingent liabilities at the date of the consolidated financial statements and reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are continuously evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes can differ from these estimates. In particular, information about significant areas of estimation uncertainty considered by management in preparing the consolidated financial statements is described in more detail in Note 3 and Note 8 of the Q3 2019 Financial Statements.

5. New Accounting Standards and Interpretations

The Company has adopted the following new and revised standards, along with all consequential amendments, effective October 1, 2018:

IFRS 9 – Financial Instruments

IFRS 9, Financial Instruments was issued in final form by the IASB in July 2014 and will replace IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 uses a single approach to determine whether a financial asset is measured at amortized cost or fair value, replacing the multiple rules in IAS 39. The approach in IFRS 9 is based on how an entity manages its financial instruments in the context of its business model and the contractual cash flow characteristics of the financial assets.

Most requirements in IAS 39 for classification and measurement of financial liabilities were carried forward unchanged to IFRS 9. The new standard also amends the impairment model by introducing a new ‘expected credit loss’ model for calculating impairment. IFRS 9 also includes a new general hedge accounting standard which aligns hedge accounting more closely with risk management. This new standard does not fundamentally change the types of hedging relationships or the requirement to measure and recognize ineffectiveness, however it will provide more hedging strategies that are used for risk management to qualify for hedge accounting and introduce more judgment to assess the effectiveness of a hedging relationship.

The Company adopted IFRS 9 on October 1, 2018 and has determined that there was no material impact on its consolidated financial statements as a result of the adoption.

IFRS 15 – Revenue from Contracts with Customers

IFRS 15, “Revenue from Contracts with Customers”: the standard was issued in May 2014 and amended in April 2016. IFRS 15 applies to contracts with customers, excluding, most notably, insurance and leasing contracts. IFRS 15 prescribes a framework in accounting for revenues from contracts within its scope, including (a) identifying the contract, (b) identify separate performance obligations in the contract, (c) determine the transaction price of the contract, (d) allocate the transaction price to the performance obligations and (e) recognize revenues when each performance obligation is satisfied. IFRS 15 also prescribes additional financial statement presentations and disclosures. The Company adopted IFRS 15 on October 1, 2018, under the modified retrospective method where the cumulative effect is recognized at the date of initial application. It has been concluded that the adoption of IFRS 15 had no material effect on the Company’s consolidated financial statements.

IFRS 16 – Leases

In January 2016, the IASB issued IFRS 16 – Leases (“IFRS 16”), which replaces IAS 17 – Leases (“IAS 17”) and related interpretations. IFRS 16 provides a single lessee accounting model, requiring the recognition of assets and liabilities for all leases, unless the lease term is 12-months or less or the underlying asset has a low value. A lessee is required to recognize a right-of-use asset representing its right to use the underlying asset and a lease liability representing its obligation to make lease payments. IFRS 16 substantially carries forward the lessor accounting in IAS 17 with the distinction between operating leases and finance leases being retained while requiring enhanced disclosures to be provided by lessors. Other areas of the lease accounting model have been impacted, including the definition of a lease.

The new standard is effective for the Company on October 1, 2019. The Company does not expect to adopt IFRS prior to its mandatory effective date. The impact that adoption of IFRS 16 will have on the consolidated financial statements has not yet been determined.

6. Related Party Transactions

During Q3 2019, the Company paid or accrued compensation to key management personnel, which includes officers and directors, in accordance with the terms of their compensation arrangements of $637 (Q3 2018 – $224).

During H3 2019, the Company paid or accrued compensation to key management personnel, which includes officers and directors, in accordance with the terms of their compensation arrangements of $1,019 (H3 2018 – $792). No amounts are owing to key management personnel.

During fiscal 2018, the Company incurred certain costs on behalf of the Company’s Chief Executive Officer in the amount of $259 which was repaid to the Company during Q3 2019.

The Company has a convertible debenture of $6,000 owing to DRAG, a company that is an existing shareholder of Almonty, and whose CEO is a member of the Board of Directors of the Company. During 2017, the maturity date of the debenture, which was originally due in March 2017, was extended to March 2019 (and, during Q1 2019, extended further to March 2021). The Company has also issued US$2,000 of secured promissory notes to DRAG during fiscal 2016 and 2017. During H3 2019, interest of $362 was accrued on the DRAG loans (H3 2018 – $297). As of June 30, 2019, there is $935 (September 30, 2018 – $576) of unpaid interest on these loans included in accounts payable and accrued liabilities.

On December 18, 2018, the Company completed a non-brokered private placement of an unsecured convertible debenture with a principal amount of $2,000, which debenture was acquired by DRAG. (See Liquidity and Capital Resources section above).

7. General

Summary of the Company’s Long-Term Supply Agreements

Almonty, along with Daytal and Beralt, is a party to two long-term supply agreements dated September 23, 2011 and February 12, 2016 with one customer who participates in the global tungsten business. In the case of Daytal, the long-term supply agreement is dated September 23, 2011 and runs for a period of 10 years (the “Los Santos Supply Agreement”). In the case of Beralt, the long-term supply agreement is dated February 12, 2016 and runs for a period of 5 years (the “Beralt Supply Agreement” and, together with the Los Santos Supply Agreement, the “Supply Agreements”). The Supply Agreements provide for the supply of a minimum amount of tungsten concentrate to the customer in accordance with certain specifications of the customer. Pricing is based on a formula derived from the prior month’s average of the high and low price for European APT per MTU as quoted on the MB and Metal Pages tungsten pricing service. Each agreement has an automatic renewal for an additional two years (unless either party provides at least three months’ notice of its intention not to renew). The customer was also granted a right of first refusal for any tungsten concentrate (that meets the customer’s specifications) produced by Almonty under each contract which exceeds the minimum amount required to be shipped under the terms of the relevant Supply Agreement.

The Company entered into Amendment No. 2 of the Los Santos Supply Agreement on April 20, 2015 where by the pricing mechanism was adjusted to reflect the inclusion of a secondary source for pricing of APT as well as an adjustment to the timing of the monthly average APT price used in the determining the selling price of concentrate.

The Company entered into Amendment No. 3 of the Los Santos Supply Agreement on February 8, 2016 whereby the Company extended the term of the Los Santos Supply Agreement for an additional 5 years.

The Company entered into Amendment No. 4 of the Los Santos Supply Agreement on April 1, 2016 whereby the Company amended the pricing mechanism under the contract.

The Company entered into Amendment No. 5 of the Los Santos Supply Agreement on February 1, 2017 whereby the Company amended the pricing mechanism under the contract.

The Company entered into Amendment No. 6 of the Los Santos Supply Agreement on February 22, 2017 whereby the Company amended the contracted volumes deliverable under the contract.

A redacted copy of each of the Supply Agreements and the related amendments thereto is available on SEDAR under Almonty’s profile at www.sedar.com.

Risks and Uncertainties

The Company operates in the mining industry, which is subject to numerous significant risks that can influence profitability. The Company has disclosed several risks below which it believes to be the most significant and that could have a material impact on its current and future operations. Other risks may exist or may arise at a future date. For additional, and more detailed, risk factors, please see the Company’s Annual Information Form dated January 11, 2019, under the heading “Risk Factors”.

Financial Risks

Financial Risk Management Objectives and Policies:

Almonty’s principal financial instruments are comprised of cash deposits, bank indebtedness and longterm debt. The main purpose of these instruments is to provide cash flow funding for the operations of Almonty and its subsidiaries. Almonty has various other financial assets and liabilities such as trade receivables and trade payables, which arise directly from operations.

The main risks arising from Almonty’s financial instruments are interest rate risk, foreign currency risk, commodity price risk, credit risk and liquidity risk.

Interest rate risk

Almonty’s exposure to the risk of changes in market interest rates relates to cash at banks and long-term debt with a floating interest rate. Of the long-term debt, $28,530 is subject to floating interest rates and $21,159 is subject to fixed interest rates. A portion of the floating rate debt totaling $7,602 is subject to a fixed spread over the 6- and 12-month Euro Interbank Offered Rate (“Euribor”) rates. A change of 100 basis points (1%) in the rates would result in a $76 change in annual interest costs. The remaining floating rate debt of $20,928 is based on a fixed spread over the 3-month Libor rate. A change of 100 basis point (1.0%) in the 3-month Libor rate would result in a $183 change in annual interest costs.

The Company may in the future become a borrower of an additional material amount of funds or repay its existing outstanding long-term debt at any time without penalty. The Company’s primary operations are located in Spain, Korea and Portugal. The ongoing uncertainty in the financial markets may have a negative impact on both the Company’s future borrowing costs and its ability to obtain debt financing.

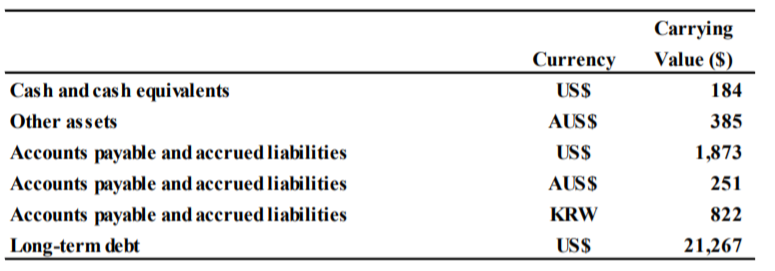

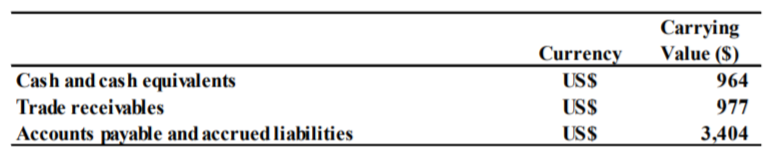

Foreign currency risk

Almonty’s wholly-owned subsidiaries, Daytal and BTW, operate in Spain and Portugal, respectively, both of which use Euros (€) as their functional currency. Their output is a commodity that is primarily priced in United States dollars (US$) which is different than the functional currency of the Company and its subsidiaries, and the Company and its subsidiaries may also incur costs or obtain indebtedness in a currency that is different from their functional currency. Almonty’s functional currency is the Canadian dollar (CAD$) but it advances funds to subsidiaries in the functional currency of the subsidiary to which funds are advanced. As such, the Company’s interim condensed consolidated balance sheet and profit or loss can be significantly affected by movements in various currencies (CAD$, US$, AUD$ and €).

The Company’s Canadian dollar functional currency businesses have the following financial instruments denominated in foreign currencies:

A 5% change in the value of the CAD$ relative to the above currencies would change net loss for the nine months ended June 30, 2019 by approximately $1,182. The Company’s Euro functional currency businesses have the following financial instruments denominated in foreign currencies:

A 5% change in the value of the Euro relative to the above currencies would have change net loss for the nine months ended June 30, 2019 by approximately $73.

Credit risk

The carrying value of the cash and cash equivalents, trade receivables, restricted cash and other assets totaling $7,829 represents Almonty’s maximum exposure to credit risk.

Liquidity risk

The Company’s objective is to use cash and cash equivalents, finance leases, and third party short and long-term loans (see Note 8 of the Company’s Q3 2019 financial statements for debt maturities) and equity in order to maintain liquidity. Almonty’s policy is to maximize liquidity in order to enable the continued development of the mines and operations of the plants and to enable the development of its projects. All financial liabilities with a contractual term of 12 months or less are classified as current. The Company is currently pursuing debt and equity financing opportunities to increase its liquidity.

Commodity price risk

Almonty’s policy is to maintain exposure to commodity price movements at its mining operations. The timing and amounts of payments of interest and principal under one of the Company’s credit facilities is based on APT pricing levels (Note 8 in the Q3 2019 Financial Statements).

Economic Dependency

Daytal, Beralt and, together with Almonty, are parties to the Supply Agreements with one customer. Almonty is economically dependent on the revenue received from the customer in order to be able to meet its current obligations and is subject to the pricing terms set out in the Supply Agreements. There is no guarantee that Almonty would be able to find an alternative customer or customers on terms similar to its existing Supply Agreements should the customer cease operations or become unable to pay Almonty under the Supply Agreements. See above within this MD&A for further details.

Tungsten Market

There is no assurance that a profitable market will continue to exist for the sale of tungsten. Tungsten prices have experienced significant movement over short periods of time and are affected by numerous factors beyond the Company’s control, such as international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumption and demand patters, speculative activities and increased production due to improved mining and production methods. Tungsten prices may be negatively affected by any slowing of the global economy, increases in exports from one market economy countries, notably China, and the release of tungsten concentrate onto the market from the U.S. National Defence Stockpile.

Operational Risks

Production

Daytal’s contract with Movimentos de Tierras Y Excavaciones, S.L.U. (“MOVITEX”), under which MOVITEX carries out contract mining activities for Daytal at the Los Santos Mine, was entered into for the life of the Los Santos Mine with an effective date of January 15, 2014. Daytal currently does not have any mining capabilities of its own and relies on MOVITEX for all mining activity, including waste rock removal, pit development and delivery of ore to Daytal’s crushing and processing plant. There is no guarantee that Daytal would be able to replace MOVITEX with another contract mining firm if MOVITEX were no longer able to provide contract mining services to Daytal. Any disruption in the contract mining services provide by MOVITEX would have a negative impact on Daytal’s short-term economic viability.

Competition

The mining industry is very competitive, and the Company has to compete with other companies related to the acquisition of attractive mineral properties and the retention of skilled labour. Many competitors possess greater financial, technical and other resources than the Company. As a result, the Company may be faced with a shortage or no supply of ore or employees, as well as not being able to maintain or acquire mineral properties on reasonable terms or at all.

Risks Related to Property Title

Although the Company leases all of the land of the Los Santos Mine from third party property owners as well as the two closest municipalities to the Los Santos Mine and the Company has obtained legal opinions on the titles to all of its properties, and although it has taken reasonable measures to ensure that all property titles are valid, there is no certainty that the property titles will not be challenged or questioned. Third parties could have valid claims to the lands occupied by the Company or immediately adjacent to the Company’s leased lands.

Dependence on Key Personnel

The Company is dependent on a relatively small number of key employees, of which the loss of any could have an adverse effect on its operations.

Laws and Regulations

The Company’s exploration and development projects are subject to laws and regulations, including those concerning mining as well as environmental and health and safety matters. The laws and regulations in place are susceptible to change and the impact of any modification is difficult to measure. The Company’s policy is to maintain safe working conditions in compliance with applicable health and safety rules.

Licenses and Permits

There can be no guarantees that the Company will be able to obtain or maintain all the necessary licenses and permits to extract and process minerals, explore, develop, or maintain its continued operations, or that the Company will be able to comply with all the conditions imposed. The current operating permits and plant capacity limitations at the Los Santos Mine allows Almonty to process up to 500,000 tonnes of ore per annum. Any increase in available ore or significant increase in the concentration of tungsten contained in the ore may require the Company to expand its production and processing capabilities. The current operating permits and plant capacity limitations at the Panasqueira Mine allow Almonty to process up to 865,000 tonnes of ore per annum. Almonty completed an engineering study at the Sangdong Mine and was granted all the necessary surface permits enabling the Company to begin

building the Sangdong Mine. The Company is working with POSCO as its EPC contractor for the construction of the mine and anticipates beginning the buildout of the mine once funding for the project has been secured. There is no guarantee that Almonty will be able to raise sufficient capital to fund the construction of the Sangdong Mine.

The mining license for the Los Santos Mine was granted in September 2002, for a period of 30 years and is extendable for 90 years. Daytal has to pay annual land taxes (approximately €2 per year) to the Spanish government. This amount is related to the surface covered and not to the production of minerals. There are no other royalty payments.

The current approved mine plan covers the period from January 2017 to January 2022 and comprises estimates of minimal disturbance activities during that period. The Company can revise and resubmit the mine plan within that period depending upon anticipated activities in future years.

The Company files applications in the ordinary course to renew the permits associated with its mining license that it deems necessary and/or advisable for the continued operation of its business. Certain of the Company’s permits to operate that are associated with the mining license are currently under application for renewal. There is no guarantee that Almonty will be able to renew the necessary permits in order to continue operating.

As at June 30, 2019, Almonty has recognized a restoration provision of $768 (September 30, 2018 – $746) with respect to Daytal’s future obligation to restore and reclaim the mine once it has ceased to mine tungsten ore from the Los Santos Mine. The restoration provision represents the present value of rehabilitation costs relating to the mine site which are expected to be incurred in 2021 after the Los Santos Mine ceases to mine ore based on the current estimate of economically recoverable ore resources. This provision has been created based on Almonty’s internal estimates. Assumptions based on the current economic environment have been made, which management believes are a reasonable basis upon which to estimate the future liability. These estimates are reviewed regularly to take into account any material changes to the assumptions. Actual rehabilitation costs will ultimately depend upon future market prices for the necessary decommissioning works required which will reflect current market conditions at that time. The timing of the rehabilitation is likely to depend on when the Los Santos Mine ceases to produce at economically viable rates. This in turn will depend on Almonty’s ability to extend the mine life years through additional exploration and also on the future price of WO3 concentrate. The Company has had its mine plan approved by the local mining and environmental authorities in the Province Salamanca and is currently awaiting approval of the regional mining authority in Castilla y Leon. Almonty’s current mine plan entails ongoing reclamation work of the site as part of the pit optimization work (several small pits that have been fully mined are filled in and reclaimed as part of the regular waste rock movement and stripping work carried on other pits that are in production, as opposed to hauling the waste rock to the waste dump). The current mine plan under review by the relevant authorities entails the reclamation of the majority of the site as part of on-going operations and waste rock movement. The restoration provision currently recognized by the Company is estimated to be sufficient to cover any remedial restoration and reclamation work needed upon completion of the tailings reprocessing operation. Upon completion of open pit mining operations, during the period when the Company will process the bulk of its inventory stock pile of mineralized tailings, Almonty estimates that the current restoration provision will be sufficient to complete all reclamation work required under its mine plan. The relevant Spanish authorities may determine, upon final review, that the amount required to be posted for future reclamation work be increased. Upon approval of the mine plan the Company intends to arrange an insurance policy to cover any increase in the assessed reclamation requirements. The Company anticipates that it will receive approval of its mine plan for the Los Santos Mine in early calendar 2019 (the updated plan was originally filed in February 2015). The Company continues to work with the relevant authorities in Spain with respect to obtaining approval of its mine plan and is also engaged in active discussions with several insurance brokers to renew the insurance policy to cover the life of mine. The Company had posted an insurance policy to cover the anticipated reclamation costs when it originally filed its updated mine plan in February 2015. This policy expired in July 2016 and will be renewed upon final approval of the mine plan as filed. The relevant Spanish authorities are aware of the lapse in insurance coverage and are continuing their review of the mine plan as filed.

Banco Popular has posted a bank warranty of €180 ($268) on behalf of Daytal with the Region of Castilla y Leon, Trade and Industry Department as a form of deposit to cover the expected costs of restoring the Los Santos Mine as required by Daytal’s Environmental Impact Statement that forms a part of its mining and exploitation license on the Los Santos Mine provision. The bank warranty cannot be cancelled unless such cancellation is approved by the government of Castilla y Leon upon approval of the completion of the restoration work. The bank warranty is undrawn and carries a quarterly stand-by fee of approximately €1 per quarter.

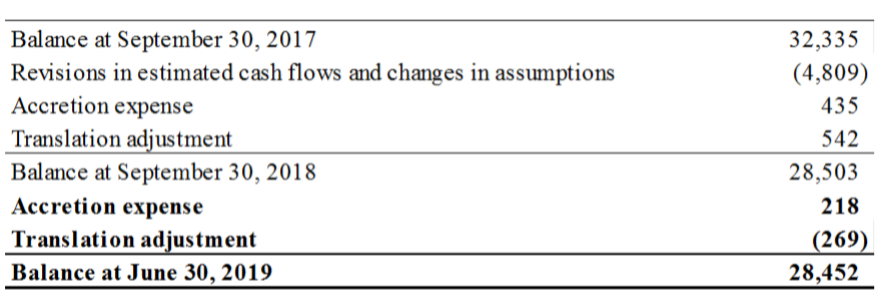

There is a restoration provision of $487 (September 30, 2018-$482) with respect to the Sangdong Mine based on the amount assessed by the relevant local government authorities. As at December 31, 2018, there is a restoration provision of $25,094 (September 30, 2018 – $25,130) with respect to the Panasqueira Mine’s future obligation to restore and reclaim the mine once it has ceased to mine ore, currently estimated to be in the year 2038. The restoration provision represents the present value of rehabilitation costs relating to the mine site which are expected to be incurred subsequent to 2038. Total rehabilitation costs relating to the mine site are estimated to be $26,649 and are expected to be incurred after the mine ceases production. Assumptions based on the current economic environment have been made, which management believes are a reasonable basis upon which to estimate the future

liability. These estimates are reviewed regularly to take into account any material changes to the assumptions. Actual rehabilitation costs will ultimately depend upon future market prices for the necessary decommissioning works required which will reflect current market conditions at that time. The timing of the rehabilitation is likely to depend on when the mine ceases to produce at economically viable rates. This in turn will depend on Almonty’s ability to extend the mine life years through additional exploration and also on the future price of WO3 concentrate.

A summary of the Company’s restoration provision is presented below:

Political Risk

The Spanish, Portuguese and South Korean governments currently support the development of their natural resources by foreign and domestic companies. However, there is no assurance the government will not adopt different policies regarding foreign ownership of mineral resources, taxation, exchange rates, environmental protection, labour relations, repatriation of income or expropriation in the future.

Litigation

All industries, including the mining industry, are subject to legal claims, with and without merit. The Company has in the past and may in the future be involved in various legal proceedings. While the Company is not aware of any possible legal proceeding that could have a material adverse effect on its financial position, future cash flow or results of operations of the Company, due to the inherent uncertainty of the litigation process and the defence costs which may have to be incurred, even with respect to claims that have not merit, there can be no assurance that the resolution of any particular legal proceeding will not have a material adverse effect on the Company.

Risks Linked to Common Shares

The price of the common shares of Almonty may fluctuate for several reasons such as production and/or exploration results or operating results and cash flow, exchange rates, available financing, lack of liquidity and several other factors. It is possible that the price of a common share of Almonty may experience significant fluctuations and that such price might be less than the actual price paid by an investor.

8. Disclosure Control and Procedures and Internal Control of Financial Reporting

The Company’s management, under the supervision of the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), has designed disclosure controls and procedures (“DC&P”) and internal control over financial reporting (“ICFR”), as defined in National Instrument 52-109, Certification of Disclosure in Issuers’ Annual and Interim Filings, based on the Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

DC&P are designed to provide reasonable assurance that material information relating to the Company is made known to the CEO and CFO during the reporting period and the information required to be disclosed by the Company is recorded, processed, summarized and reported in a timely and appropriate manner. ICFR is designed to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with international financial reporting standards. Due to the inherent limitations associated with any such controls and procedures, management recognizes that, no matter how well designed and operated, they may not prevent or

detect misstatements on a timely basis.

The Company’s management, under the supervision of the CEO and CFO, has evaluated the design effectiveness of its DC&P and ICFR and concluded that, as of June 30, 2019, they are effective in providing reasonable assurance regarding required disclosures and the reliability of external financial reporting.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

National Instrument 52-109 also requires Canadian public companies to disclose any changes in ICFR during the most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, ICFR. With the exception of remediation of material weaknesses in ICFR that were identified and disclosed in relation to the year ended September 30, 2018, no changes were made to the Company’s ICFR during the nine months ended June 30, 2019 which have materially affected, or are reasonably likely to materially affect, ICFR.

9. Management’s Responsibility for Financial Statements

The information provided in this report, including the Company’s financial statements, is the responsibility of management. In the preparation of these statements, estimates are sometimes necessary to make a determination of future values for certain assets or liabilities. Management believes such estimates have been based on careful judgements and have been properly reflected in the accompanying financial statements.

August 14, 2019

On behalf of Management and the Board of Directors,

“Lewis Black”

Chairman, President and Chief Executive Officer

Glossary of Terms

APT

ammonium para tungstate is an intermediate product which is one of the

principal chemical forms in which tungsten is traded

Concentrates

the valuable fraction of an ore that is left after waste material is removed

in processing

€

Euros

MB

Metal Bulletin of London

MTU

metric tonne unit, equal to 1 percent of a metric tonne or 10 kg (22.046

pounds) of contained WO3

NI 43-101

National Instrument 43-101 – Standards of Disclosure for Mineral Projects

Scheelite

a brown tetragonal mineral, CaWO4. It is found in pneumatolytic veins associated with quartz and fluoresces to show a blue color. Scheelite is a mineral of tungsten

Tonne

a metric unit equal to 1,000kg (2,204.6 pounds)

Tungsten concentrates

concentrates generally containing between 40 and 75 percent WO3

US$

United States dollars

W

the elemental symbol for tungsten

WO3

tungsten tri-oxide, a compound of tungsten and oxygen