Toronto – January 06, 2022, – Almonty Industries Inc. (“Almonty” or the “Company”) (TSX: AII / ASX: AII / OTCQX: ALMTF / Frankfurt: ALI.F) is pleased to provide an update of its South Korean operations.

Editor’s note:

This is an era in which the economy determines the survival of a country. As the tendency to weaponize resources becomes evident, the priorities of security are being reversed. China is running rampant. The ‘vitamins of the high-tech industry’ are rare earth metals (such as tungsten). The United States is drawing in its allies to exert pressure on the procurement of key strategic materials. Japan is reviving the practice of raising rice self-sufficiency by promoting ‘food security’. So diagnose Korea’s response strategy…

Almonty Korea Tungsten Corporation (Previously KTC, Dae-Han-Jung-Seok), tungsten producer, declared tungsten production in Sangdong-eup, Yeongwol-gun, Gangwon-do last year, for the first time in about 20 years since the mine closure in 1993.

Korea, which was a global tungsten producer until the 1970s, was pushed down by China’s “aggressive dumping strategy”, therefore becoming an importer of tungsten from 1980s,

However, China’s recent signs of resource weaponization have made a reversal.

Almonty, one of the world-leading large corporation, has invested in Korea’s tungsten production.

Considering the reserves of about 5,800 tons, the company expects that there will be no worries regarding tungsten shortage for about 60 years from next year.

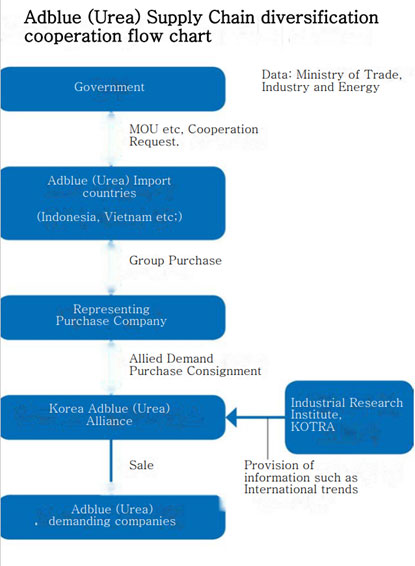

On the 22nd of last month, Minister of Trande, Industry and Energy, Seung-wook Moon signed an “Adblue (urea) supply co-operation agreement) with the Minister of Trade, Industry and Energy of Vietnam.

It was the result of desperate efforts to diversify import sources when the amount of Adblue ran out due to China’s export restrictions.

It is expected that up to 120,000 tonnes of Adblue (urea) per year will be imported from Vietnam for three years and is equivalent to 30% of imports in 2020 (370,000 tonnes)

The Government official have stated that “the shortage of Adblue (Urea) has come to an end”

The government and the domestic industry are now facing the challenge of ‘improving the supply chain structure’.

In order to prepare for the ‘weaponisation of resources’ that is spreading around the world, they are taking out all the cards they have not thought about before, such as diversification of import sources and domestic production.

An industry official has stated, “Adblue and Tungsten were items where domestic product capacity has collapsed due to China’s aggressive low-price strategy in the past”, and “last year’s Adblue crisis overturned the economic logic of the past and brought the issue of supply chain instability to the surface in earnest,” he stated.

Completely overhauled Government supply chain response system.

According to the Government and relevant industries on the 5th, the “pan-ministerial Task Force (referred as TF) on key items for economic security” is organized by the Government in November last year is a symbolic change in the field of economic security.

Currently, about 200 items will be managed by the TF, have been selected in consideration of their impact on the domestic economy and external dependence.

The Government plans to discover additional items to be managed by the first quarter of this year.

Items subject to management are intensively managed and periodically adjusted through the Early Warning System (EWS) by grading them into 4 levels (A-B-C-D) per their importance.

Experts point out that such an active response by the government is not only essential in an era of increasingly severe economic security, but also needs to be continuously revised and supplemented.

Seo Yong-gu, a professor of economics at Sookmyung Women’s University, stated that, “It can be seen that globalisation of the United States has come to an end. Considering the domestic economic environment that relies on trade, the time has come for the role of the government to be more important than ever.”

In fact, while strengthening the response system for vulnerable items, the government is preparing various supply and demand strategies such as expansion of stockpiles; diversification of import sources; conversion of domestic production and international cooperation.

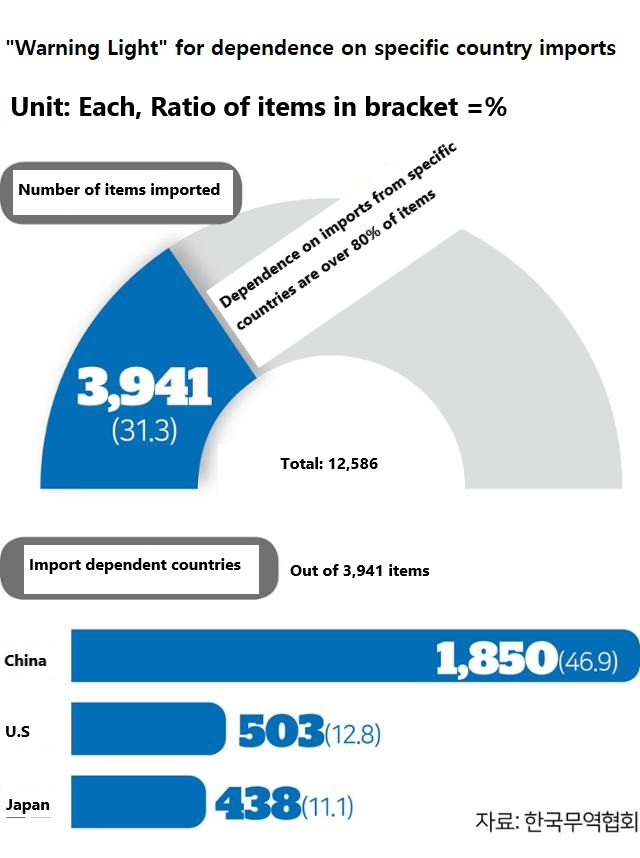

For security reasons, the Government is not disclosing resources with weak supply externally, but looking at the data of the Korea International Trade Association, items with high trade dependence can roughly be identified

According to the Korea International Trade Association, a whopping 3,941 (31.3%) of the 12,586 items that Korea imported from January to September last year were 80% or more dependent on specific countries

In particular, 1,850 items imported from China accounted for more than 80% of the total, which was more concentrated than the US (503 items) and Japan (438 items).

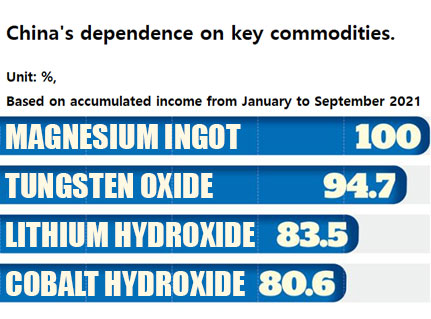

Magnesium ingots, where its material prices have soared since last year, are still 100% dependent on Chinese imports.

However, in the case of tungsten oxide, which relies on Chinese products for 94.7%, it is expected that dependence on tungsten oxide can be greatly reduced once domestic production starts, as in the case of Almonty Korea Tungsten Corporation.

Still a long way to go… Must stay vigilant on the gap between the rich and the poor on resources.

If the government’s efforts to stabilise supply and demand results in success, it is expected that a much more stable management system will be established than before.

However, industry and academic circles point out that “there are still holes” and that the government should communicate with the industry from time to time and take a more proactive response.

Even after experiencing Japan’s export restrictions on semiconductor-related products just three years ago, the government’s response, which was neither agile nor detailed, should have not been repeated at the time of the Adblue crisis last year.

In fact, on the 3rd, an official from the oil industry who is located near Incheon’s North Port said, “The government’s response to the Adblue incident was appalling and there were quite a lot of confusion at the site.”

“Without any word from the Government, the announcement from Government was that the supply of Adblue was limited to selected service stations, and countless vehicles that were turned around due to this, and service station selection was randomized which caused significant losses to those who were not selected for distribution”

He said, “Most of all, in the past, if the supply was low, it could be obtained at a high price, but now, there is a widespread belief that if one essential item stops, the entire industry may be in trouble.”

There are also concerns that the phenomenon of “gap between the rich and poor” of essential items will become clearer in the future depending on the size of the company, capital, and information power.

Mr, Kwon(61), a freight forwarder, said, “Even during the Adblue crisis, large transport companies that were able to stockpile large quantities of Adblue passed the year without much worry, but Individual business owners were only able to operate their vehicle by paying more or buying them through direct overseas purchases.” “This gap is only going to grow, and the government should take a closer look at the scene,” he advised.

Follow Us - Stay in touch and up to date:

Latest News

Almonty Closes Additional Tranches of Private Placement

Almonty is pleased to announce it has closed three tranches of its non-brokered private placement through the sale of 4,263,263 units (“CDN Units”) at a price of CDN$0.55 per CDN Unit, raising gross proceeds of CDN$2,344,795, and 1,525,000 Chess Depository Interests units (“CDI Units”) at a price of A$0.62 per CDI Unit, raising gross proceeds of A$945,000.

Almonty Announces the Filing of its Audited Annual Consolidated Financial Statements, MD&A & AIF for the Year Ended December 31, 2023 and $2.2M in Positive EBITDA from Mining Operations

Almonty Announces the Filing of its Audited Annual Consolidated Financial Statements, MD&A & AIF for the Year Ended December 31, 2023 and $2.2M in Positive EBITDA from Mining Operations.

Placement of Common Share Units and CDI’s raises C$1.47M with Further Commitments of C$1.178 million for acceleration of Tungsten downstream planning and Molybdenum reserves conversion.

Almonty Industries Inc. is pleased to announce that it has closed on a non-brokered private placement through the sale of 2,668,000 units (“CDN Units”) at a price of $0.55 per unit raising gross proceeds of $1,467,400.

About Almonty

The principal business of Toronto, Canada-based Almonty Industries Inc. is the mining, processing and shipping of tungsten concentrate from its Los Santos Mine in western Spain and its Panasqueira mine in Portugal as well as the development of its Sangdong tungsten mine in Gangwon Province, South Korea and the development of the Valtreixal tin/tungsten project in north western Spain.

The Los Santos Mine was acquired by Almonty in September 2011 and is located approximately 50 kilometres from Salamanca in western Spain and produces tungsten concentrate. The Panasqueira mine, which has been in production since 1896, is located approximately 260 kilometres northeast of Lisbon, Portugal, was acquired in January 2016 and produces tungsten concentrate.

The Sangdong mine, which was historically one of the largest tungsten mines in the world and one of the few long-life, high-grade tungsten deposits outside of China, was acquired in September 2015 through the acquisition of a 100% interest in Woulfe Mining Corp.

Almonty owns 100% of the Valtreixal tin-tungsten project in north-western Spain.

Further information about Almonty’s activities may be found at www.almonty.com and under Almonty’s profile at www.sedar.com.

Legal Notice

The release, publication or distribution of this announcement in certain jurisdictions may be restricted by law and therefore persons in such jurisdictions into which this announcement is released, published or distributed should inform themselves about and observe such restrictions.

Disclaimer for Forward-Looking Statements

When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. These statements and information are based on management’s beliefs, estimates and opinions on the date that statements are made and reflect Almonty’s current expectations.

Forward-looking statements in this press release include, but are not limited to, statements regarding the expected use of proceeds of the Debenture Offering. The forward-looking statements and information in this press release include information relating to the intentions of management. Such statements and information reflect the current view of Almonty with respect to risks and uncertainties that may cause actual results to vary. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Almonty to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: the receipt of all required approvals, unanticipated costs and expenses, general market and industry conditions and perational

risks, including large project risk and contractual factors, any specific risks relating to fluctuations in the price of ammonium para tungstate (“APT”) from which the sale price of Almonty’s tungsten concentrate is derived, actual results of mining and exploration activities, environmental, economic and political risks of the jurisdictions in which Almonty’s operations are located and changes in project parameters as plans continue to be refined, forecasts and assessments relating to Almonty’s business, credit and liquidity risks, hedging risk, competition in the mining industry, risks related to the market price of Almonty’s shares, the ability of Almonty to retain key management employees or procure the services of skilled and experienced personnel, risks related to claims and legal proceedings against Almonty and any of its operating mines, risks relating to unknown defects and impairments, risks related to the adequacy of internal control over financial reporting, risks related to governmental regulations, including environmental regulations, risks related to international operations of Almonty, risks relating to exploration, development and operations at Almonty’s tungsten mines, the ability of Almonty to obtain and maintain necessary permits, the ability of Almonty to comply with applicable laws, regulations and permitting requirements, lack of suitable infrastructure and employees to support Almonty’s mining operations, uncertainty in the accuracy of mineral reserves and mineral resources estimates, production estimates from Almonty’s mining operations, inability to replace and expand mineral reserves, uncertainties related to title and indigenous rights with respect to mineral properties owned directly or indirectly by Almonty, challenges related to global financial conditions, risks related to future sales or issuance of equity securities, differences in the interpretation or application of tax laws and regulations or accounting policies and rules of the TSX.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to, the receipt of all required final approvals, no unanticipated delays in the project financing, no material unanticipated costs and expenses, no material adverse change in general market and industry conditions and no unanticipated material operational risks, including large project risk and contractual factors, no material adverse change in the market price of APT, the continuing ability to fund or obtain funding for outstanding commitments, expectations regarding the resolution of legal and tax matters, no negative change to applicable laws, the ability to secure local contractors, employees and assistance as and when required and on reasonable terms, and such other assumptions and factors as are set out herein. Although Almonty has attempted to identify important factors that could cause actual results, level of activity, performance or achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, level of activity, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and even if events or results described in the forward-looking statements are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Almonty. Accordingly, readers should not place undue reliance on forward-looking statements and are cautioned that actual outcomes may vary.

Investors are cautioned against attributing undue certainty to forward-looking statements. Almonty cautions that the foregoing list of material factors is not exhaustive. When relying on Almonty’s forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Almonty has also assumed that material factors will not cause any forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS THE EXPECTATIONS OF ALMONTY AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE ALMONTY MAY ELECT TO DO SO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

For further information, please contact:

Lewis Black

Chairman, President and CEO

Telephone: +1 647-438-9766

E-mail: info@almonty.com

The head office of Almonty is:

100 King Street West

Suite 5700

Toronto, Ontario

M5X 1C7